Savings That Go Where You Go

|

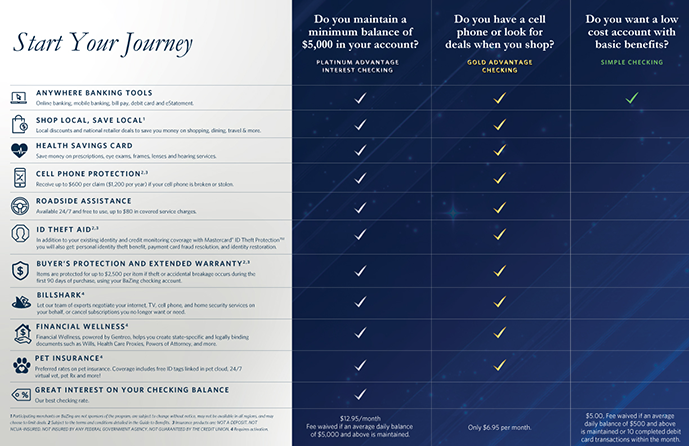

Choose Your Advantage

Platinum Advantage Interest Checking

- Interest Earning Account

- Local Deals

- ID Theft Aid

- Cell Phone Protection

- Buyers Protection

- Extended Warranty

- Health Savings Card

- Financial Wellness

- Estate Planning

- Roadside Assistance

- Billshark Negotiaton Service

- Discounted Pet Insurance

- Nationwide Travel Savings

- Entertainment Savings

- Online Retail Savings

- Anywhere Banking Tools

- $12.95 Monthly Service Fee. No fee if an average daily balance of $5,000 and above is maintained.

Gold Advantage Checking

- Local Deals

- ID Theft Aid

- Cell Phone Protection

- Buyers Protection

- Extended Warranty

- Health Savings Card

- Financial Wellness

- Estate Planning

- Roadside Assistance

- Billshark Negotiaton Service

- Discounted Pet Insurance

- Nationwide Travel Savings

- Entertainment Savings

- Online Retail Savings

- Anywhere Banking Tools

- $6.95 Monthly Service Fee

Simple

Checking

- Anywhere Banking Tools

- $5.00 Monthly Service Fee. No fee if an average daily balance of $500 and above is maintained OR 10 completed debit card transactions within the month.

Wondering Which Account is Right for You?

Answer a couple short questions to help you choose!

Question 1:

To earn a rate of interest, will you always keep more than $5,000 in your checking account?

Every Checking Account Includes:

- Membership Benefits

- 24/7 Online & Mobile Banking

- Mastercard Debit Card

- Early Direct Deposit

- uChoose Rewards®

- Send & Receive Money with Zelle®

- 30,000+ Free CO-OP ATMs & Shared Branch Access

- Free Bill Pay Service

- Free eStatements

- Telephone Banking

- Mobile Check Deposit

- Overdraft Services

Debit Mastercard® Benefits

Enjoy the following benefits when you choose the American First Debit Card:

- Tap-to-pay technology

- 24/7 fraud monitoring

- Zero liability so you only pay for what you purchased

- Mastercard Global Emergency Service

- Mastercard ID Theft Protection™

- Mastercard Transit Benefit

* Value Proposition for Platinum Advantage Interest Checking with BaZing: $1,255.00. Total annual cost ($12.95/month) = $155.40. Total net annual value = $1,099.60. Value Proposition for Gold Advantage Checking with BaZing: $1,255.00. Total annual cost ($6.95/month) = $83.40. Total net annual value = $1,171.60.

1 Participating merchants on BaZing are not sponsors of the program, are subject to change without notice, may not be available in all regions, and may choose to limit deals. 2 Subject to the terms and conditions detailed in the Benefit Reference Guide. 3 Insurance products are: NOT A DEPOSIT. NOT NCUA-INSURED. NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY. NOT GUARANTEED BY THE CREDIT UNION. 4 Requires activation. 5 Billshark charges a one-time fee of 33% of any bill reduction savings. If you don't save money there is no fee - guaranteed.